Investor Visa USA Secrets: Dubai Entrepreneurs’ Guide to U.S. Business Expansion

Expanding your Dubai-based business into the United States offers tremendous opportunity but comes with complex immigration, legal, and operational challenges. For high-net-worth entrepreneurs from Russia, India, and the CIS, interest in U.S. investor visas has surged, driven by global uncertainties and the promise of new markets. This guide provides a comprehensive roadmap to navigating the U.S. investment visa process, crafting a winning E-2 business plan, and overcoming the unique hurdles faced by CIS investors. Whether you’re seeking growth, diversification, or security for your family, this article delivers expert insights, actionable strategies, and real-world tips to empower your American business journey.

Investment Visa Process for Russian Entrepreneurs in the USA

Understanding Your Visa Options

- E-2 Treaty Investor Visa

- For nationals of countries with a U.S. treaty (neither Russia nor India currently qualify).

- Many Dubai entrepreneurs use second citizenship from countries like Grenada or Turkey to access the E-2.

- Requires a “substantial” investment (often $150,000+), real business risk, and active management.

- Renewable indefinitely as long as the business is operational. Spouses can work; children under 21 can accompany.

- L-1 Intracompany Transferee Visa

- For owners/managers transferring from a foreign (e.g., Dubai) company to a new/existing U.S. branch or subsidiary.

- Must have worked at the foreign entity for 1 of the last 3 years.

- Initial validity: up to 1 year (new office) or 3 years (existing), extendable up to 7 years.

- Offers a path to a green card via the EB-1C category. Spouses and children can come as dependents (spouses can work).

- EB-5 Investor Green Card

- Direct path to permanent residence for investors from any country.

- Minimum investment: $800,000–$1,050,000 (depending on project/location).

- Must create at least 10 full-time U.S. jobs.

- Results in a conditional green card, which becomes permanent after 2 years if criteria are met.

Step-by-Step Process

Strategic Planning & Eligibility

Assess which visa matches your background, goals, investment size, and nationality. Consider using professional consultants for a tailored strategy.

Establish or Identify a U.S. Business

Register a U.S. entity or acquire/invest in an existing business. Ensure compliance with legal structures (e.g., Delaware C-Corp, LLC) and transferability of funds.

Prepare Required Documentation

Gather personal, financial, and business documents:

- Proof of funds and legal source

- U.S. business incorporation paperwork

- Investment receipts and contracts

- Detailed business plan (essential for E-2)

- Visa-specific forms (DS-160/DS-260 for E-2/EB-5; I-129 for L-1)

Submit the Petition/Application

File the visa petition with the appropriate U.S. authority (USCIS for L-1/EB-5, consulate for E-2).

Attend the Visa Interview

Interview at the U.S. consulate (most Dubai residents use Abu Dhabi or Dubai posts). Prepare to explain your business and investment clearly.

Visa Issuance & Travel

Upon approval, receive your visa, check validity, and begin your U.S. expansion.

Timeline Expectations

- E-2 and L-1: Typically 2–6 months depending on preparation and consulate schedules.

- EB-5: 18–30 months for initial approval; possible fast track for rural projects.

- U.S. consulates have reduced interview wait times post-pandemic.

Success Tip: U.S. investor visa rules evolve frequently. With careful planning and expert guidance, chances of approval are higher than ever, as seen in record E-2 visa numbers in 2023.

How to Prepare a Business Plan for U.S. E-2 Visa Application

A robust, credible business plan is central to any E-2 application. This document convinces U.S. authorities your business is viable, impactful, and not simply a vehicle for a visa.

Purpose

- Demonstrate that the business is active and profitable.

- Show it will generate more than sufficient income to support you and your family, creating U.S. jobs and contributing to the economy.

Key Elements

- Executive Summary: Concisely describe the business, investment, and your qualifications.

- Company Description & Ownership: Outline structure, ownership (must have at least 50% control), and U.S. incorporation details.

- Market Analysis: Present research on U.S. industry trends, target customers, and competitors. Leverage any Dubai/GCC success as proof of concept.

- Products or Services: Explain offerings in plain English, avoiding jargon.

- Marketing & Sales Strategy: Detail customer acquisition plans, pricing strategies, and channels.

- Operations Plan: Describe location, facilities, daily operations, and initial staffing.

- Management & Personnel: Highlight management bios and job creation plans (when and how many U.S. employees will be hired).

- Financial Projections: Provide detailed five-year forecasts (revenue, expenses, profits, cash flow) with clear, logical assumptions.

- Investment Breakdown: Account for funds already spent/committed and plan for deployment of remaining capital.

- Timeline & Milestones: Map out key growth steps—launch, break-even, expansion.

- Supporting Documents: Include market research, letters of intent, contracts, and leases.

Crafting Tips

- Use clear, concise language—avoid excessive technicalities.

- Visuals (charts/graphs) are useful if they clarify data.

- Plan length: typically 15–20 pages, focusing only on essentials.

- Review and refine repeatedly; have professionals critique for weak points.

Professional Assistance

Many entrepreneurs use specialist consultants to ensure their plan meets U.S. consular expectations and provides a strong blueprint for business success.

U.S. Business Expansion Tips for Dubai-Based Startups

Expanding into the U.S. requires strategic adjustments beyond immigration compliance.

Essential Strategies

- Understand U.S. Business Culture & Regulations Expect a faster pace, direct communication, and rigorous documentation. Hire a U.S. attorney and accountant to navigate incorporation, tax, and compliance.

- Choose the Right Structure & Location Delaware C-Corp is popular for startups, but consider business goals and ownership needs. Location should align with industry (e.g., tech in Silicon Valley, fashion in NYC).

- Build a Local Network Engage with U.S. business associations, accelerators, and mentors. Local advisors lend credibility and facilitate integration.

- Adapt Offerings for the U.S. Market Localize products, services, and marketing to suit American tastes. Test and iterate based on real customer feedback.

- Protect Intellectual Property Register trademarks/patents early to secure your brand and innovations.

- Plan for Funding and Cash Flow U.S. expansion is costly; maintain cash reserves and build banking relationships. Understand limits on loans for non-residents.

- Leverage Dubai Advantages Highlight strengths from the UAE, such as efficient teams or unique products.

- Understand Tax Implications Consult a cross-border tax advisor to manage U.S. and global tax exposure. Plan for currency risk if funds are held outside USD.

These measures position new ventures for sustainable success in the U.S. market.

Common Challenges for CIS Investors Entering the American Market

CIS entrepreneurs face several unique hurdles when moving into the U.S. market.

Key Challenges

- Sanctions & Banking Restrictions Russian nationals, in particular, may face tight scrutiny on funding sources due to sanctions. Use international banks in Dubai, maintain detailed documentation, and start banking relationships early.

- Language Barriers English proficiency is vital for legal and business dealings. Use translators for contracts, but improve your own business English for trust-building.

- Credit History With no U.S. credit score, securing leases, cards, or supplier terms is tougher. Offer larger deposits and use international bank references.

- Business Culture Differences U.S. practices emphasize documentation, contracts, and cautious communication. Adapt to less direct but highly procedural norms.

- Market Complexity The vast, varied U.S. market requires local research and adaptation. Avoid overgeneralizing from CIS/GCC experience.

- Immigration Rule Changes Visa requirements and processing can shift rapidly. Work with advisors to stay updated and maintain compliance.

Avoiding Common Mistakes

- Don’t Go It Alone Professional legal and immigration support is essential.

- Invest Sufficient Capital Underfunded businesses face high refusal rates.

- Prepare a Realistic, Detailed Business Plan Avoid generic or exaggerated projections.

- Maintain Visa Eligibility Actively operate the U.S. business and meet job creation promises.

- Have Backup Plans Always plan for contingencies if the venture or visa path falters.

With preparation and expert guidance, these obstacles are manageable.

Immigration Interview Tips for Russian-Speaking Business Owners

The visa interview is a decisive step. Russian-speaking and other non-native English entrepreneurs should prepare thoroughly.

Essential Preparation

- Expect English Most interviews are conducted in English and last 10–20 minutes. Practice discussing your business and investment in clear, simple language.

- Know Your Application Be able to explain your business, investment amount, funding source, and job creation plans without reading from notes.

- Bring Documents (if asked) Carry key documents in an organized folder, including translations as needed. Only offer them if requested.

- Demonstrate Strong Ties & Intent For non-immigrant visas, show you intend to return to your home country or Dubai. For green cards, express commitment to the U.S.

- Be Calm and Professional Answer truthfully and directly. If you don’t understand a question, ask for clarification.

- Show Expertise and Preparation Reference your market research, U.S. visits, or industry experience to highlight your seriousness.

- Be Ready for Detailed Questions Prepare to explain technical aspects of your business simply.

- Mind Body Language Maintain eye contact, sit upright, and project professionalism.

- Post-Interview If approved, your passport will be returned with the visa. If pending or denied, consult your advisor for next steps.

Mock interviews and practice sessions can greatly improve performance and confidence.

FAQs: Investor Visas & U.S. Expansion

- Can Indian entrepreneurs apply for the E-2 visa? Not directly. India is not a treaty country, but some Indian nationals obtain passports from eligible countries (like Grenada) to qualify.

- How much investment is needed for E-2? No legal minimum, but $100,000–$300,000 is typical depending on business size. Funds must be already spent/committed.

- Do E-2 or L-1 visas lead to a green card? E-2: No direct path, but some transition to EB-5 or EB-1C later. L-1: Can lead to green card via EB-1C if qualifying criteria are met. EB-5: Direct path to green card.

- How long does the process take? E-2 and L-1: 2–6 months typical. EB-5: 1–2+ years.

- Are there insurance requirements? No mandatory health insurance for investor visas, but private coverage is strongly recommended due to U.S. healthcare costs.

- Can my family work or study in the U.S.? Spouses of E-2/L-1 holders can work; children can attend school. Under EB-5, entire family gets green cards.

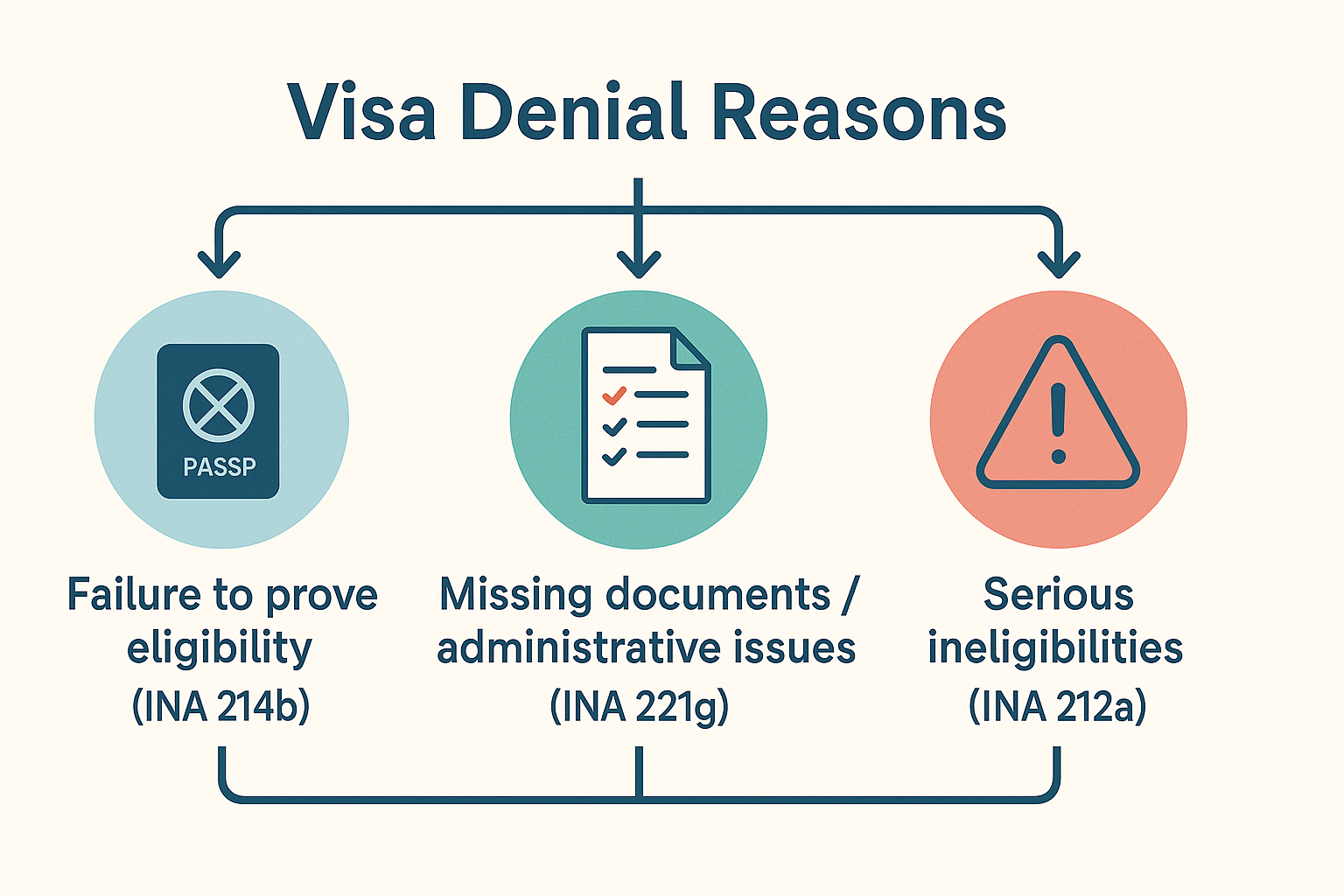

- What if my application is denied? Understand the reason, address deficiencies, and reapply or consider alternative visas. Professional help is critical after a denial.

Conclusion & Next Steps

U.S. business expansion as a Dubai-based entrepreneur is challenging but achievable with the right preparation. From selecting the best investor visa route to crafting a compelling business plan and understanding local business culture, each step requires strategic planning and expert support. Partnering with an experienced consultancy ensures comprehensive guidance, personalized strategies, and peace of mind throughout the process. If you’re ready to pursue growth, security, and global opportunity in the U.S., the next step is to engage expert advisors who can unlock your path to success. For more information on urgent U.S. investor visas, visit the USA Urgent Visa page. Take Action: Contact Us

Sources used throughout this guide include EB-5 BRICS, VisaGuide.World, NNU Immigration, and The Moscow Times.